If you’re running a power-hungry business and you have a bit of flat-ish real estate that faces the sky, you’ve probably wondered whether it would make sense to go solar. The environmental reasons are obvious. And if, like us, you value the chance to add a new source of power then the arguments in favour keep stacking up.

It can be financially appealing, too. But, as our Technical Director Quintin Russ explained to the annual conference of the New Zealand Network Operators Group (NZNOG) last week, every case is different. Here’s how it’s all worked out for us.

Our first solar year by the numbers

There are 384 panels on top of our two buildings, making for a system size of 142kWp. Each building has its own ICP (installation control point), and consequently its own inverter. We didn’t add any battery storage to the system because our datacentre constantly draws power. Anything we generate we either use or export.

In its first year this solar installation produced about 184,000 kilowatt hours (kWh) of electricity. This was only slightly short of the 190,000kWh that our installers, Trilect Solar, had estimated. It’s good to know that we were using sound numbers when we worked out the likely return on our investment.

On the environmental side, Trilect estimates that each year we’ll offset 24,000 tonnes of atmospheric CO2. There are more details in their SiteHost case study.

We can run almost entirely off-grid on a clear day. When Auckland was at its sunniest, in January, we even exported a little bit of power.

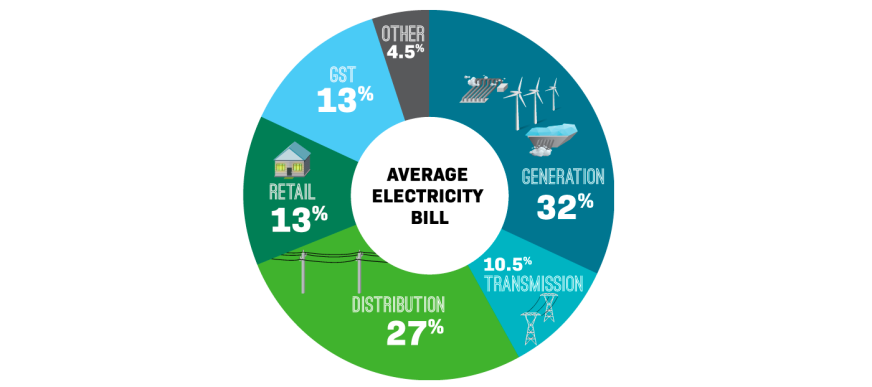

As Quintin told NZNOG, “the case for solar stacks up a lot better if you use every kilowatt-hour that you generate”. When we export power, only about one-third of its total value accrues to us. To put this another way, we can either be our own generator, transmission company, distributor and retailer; or we can be someone else’s generator.

All up, our 12 months’ experience confirmed a lot of expectations. We can now confidently say that return on investment (ROI) is about 15%, so this installation will take around 7 years to pay for itself. That compares well to the system’s guarantees and warranties, which cover periods of 10-25 years. Because we’re using almost every kWh ourselves, the financial impact works out well. If we were storing power or exporting more, “the numbers shift quite dramatically”. Since our business is built on top of constant energy draw, the move to solar has been a good one.

How we got here

Quintin also covered our solar backstory, starting with our selection of Trilect Solar to work on our installation. He says, “they’re not paying me to say this, but Andrew and Pete did an amazing job.”

As well as providing remarkably good estimates of the system’s performance, Trilect’s early advice included “about 15 different concepts for how we could lay out the panels” without affecting the air-conditioning and other bits and pieces that were already up there. They looked into other questions too, like whether the cost and complexity of angling the solar panels would pay off (answer: no). After getting everything planned out with Trilect we thought we were all good to go. There was just a quick engineering assessment to get done first.

Strength before power

Our solar ambitions hit an early snag when an engineering inspection found that one roof wasn’t as strong as we expected. The roof could keep out the rain just fine, and it was even good enough for the building to be rated well for earthquake-resistance, but it wasn’t up to the job of holding a small power plant. This gave us three options:

Strengthen the roof, which will add time and cost, but preserve the solar capacity we had expected.

Cover only 40% of the weaker roof in solar panels, saving money but generating less power.

Switch to lighter solar panels, which cost more.

In our particular case, option 2 (cutting the number of panels) weakened the business case. Option 1 (strengthen the roof) and option 3 (lighter solar panels) were both roughly cost-neutral. Since a roof lasts longer than solar panels do, we went with option 1. The wait was worth it.

Quintin’s talk was near the end of day one of NZNOG’s conference. It’s available on YouTube.

Many more good years to come

This is a long-term investment, and one that we are proud to have made. The carbon offset alone would arguably be enough of a benefit to justify the expense. But now we know that there are times when our data centre is powered purely by the sun, and that the entire system will pay for itself in seven years. We have confirmation that this is as good for business as we expected.

Even though the roof is full, there’s still plenty of room in our data centre. So if you want to discuss co-location or any other hosting options, we can definitely fit you in. Get in touch today.